Your money, in control. Now in one place.

Bonsai helps you plan, invest, and build wealth in one AI financial planning app that keeps up with your life.

house in the next 2 years.

I see, it's within reach after a few small

tweaks to how you save and invest.

as your income and spending

change.

INTRODUCING BONSAI WEALTH

Like a personal advisor in your pocket

Bonsai brings AI financial planning and investing together in an all‑in‑one money app.

Less thinking, more living

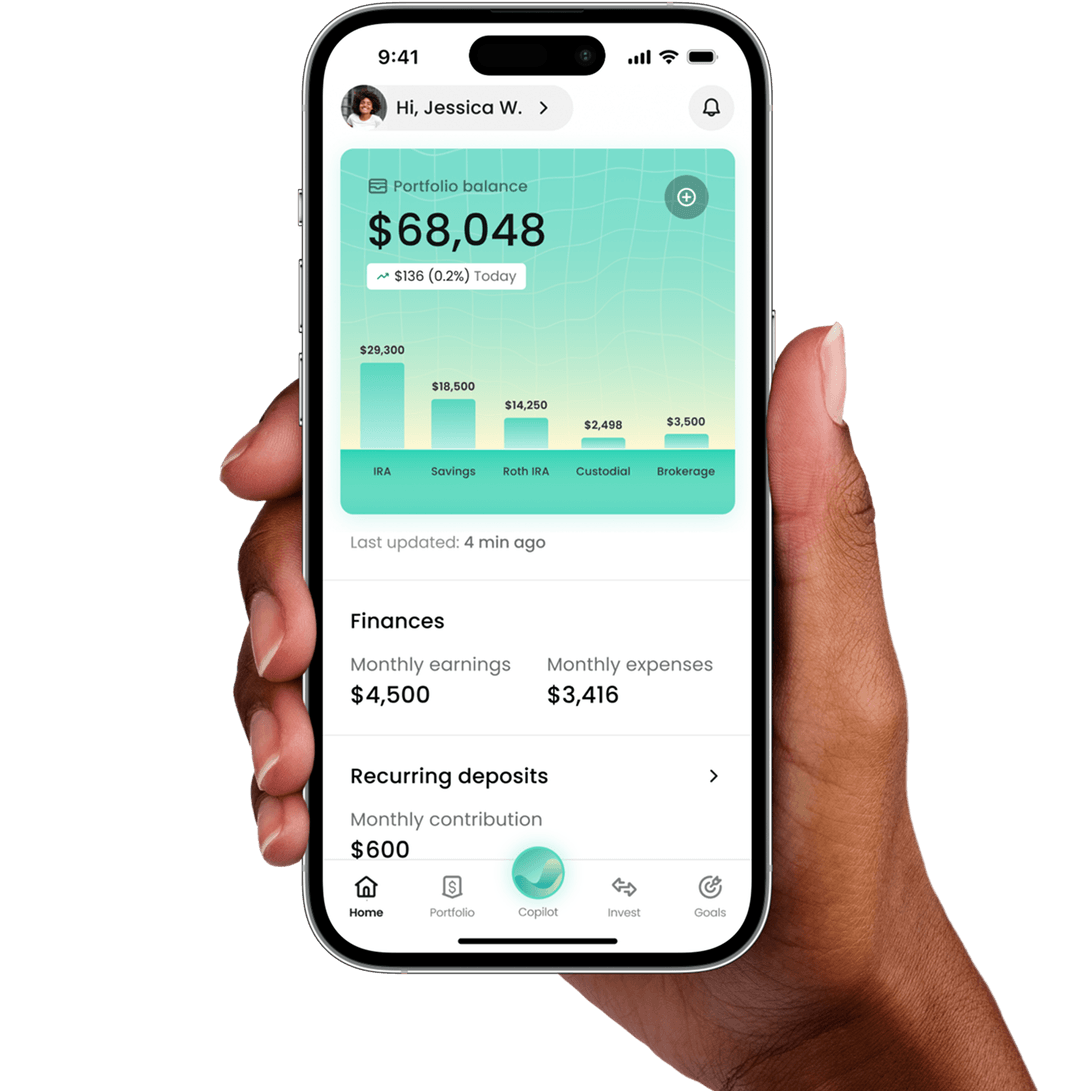

Get your full financial picture in one place with a plan that adapts as your goals or income change.

Less thinking, more living

Get your full financial picture in one place with a plan that adapts as your goals or income change.

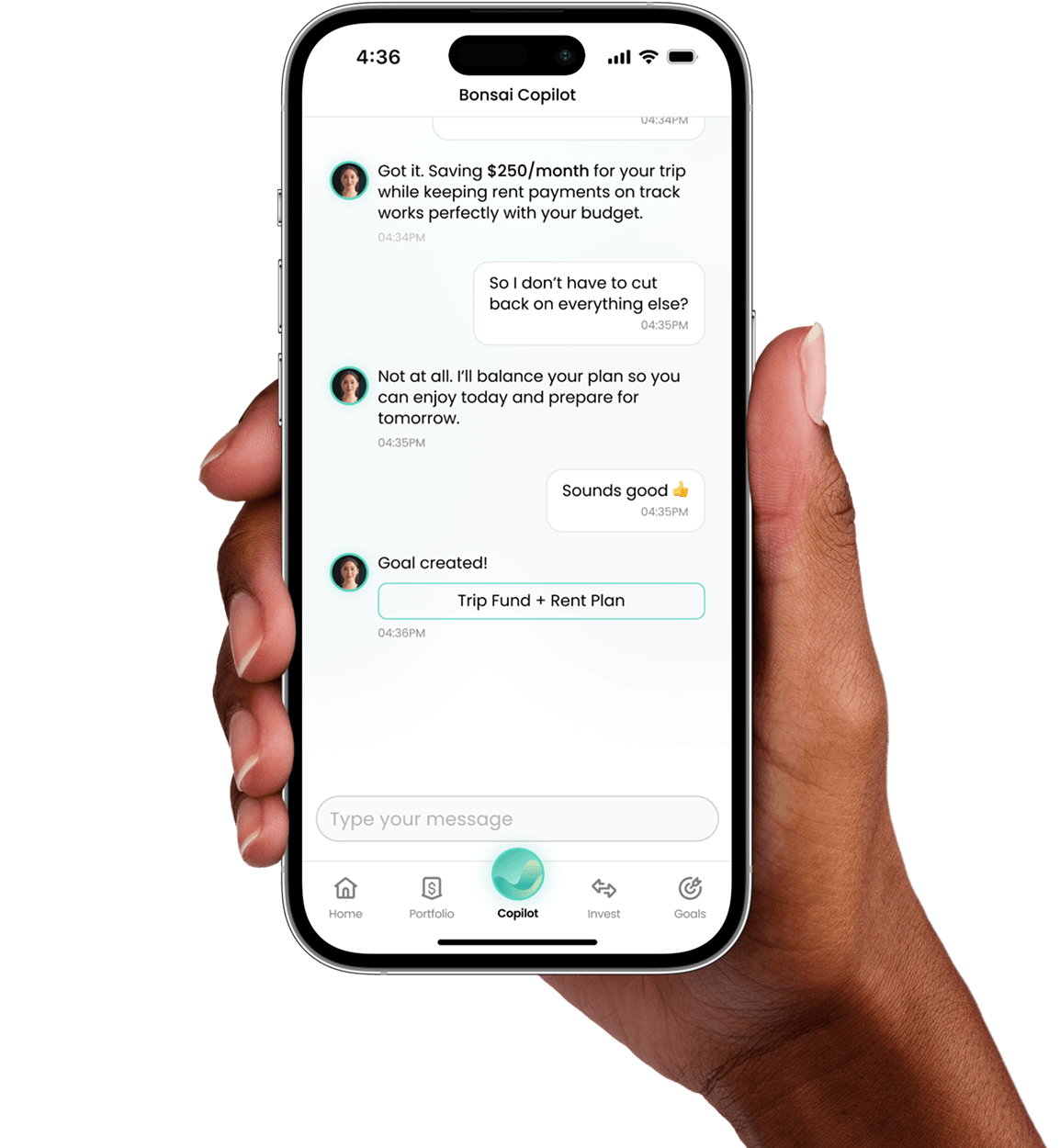

Meet Lily, your financial co-pilot

Lily keeps an eye on your plan and sends timely nudges to help you stay on track as life and markets change.

HOW IT WORKS

From setting goals to hitting life milestones

Connect your accounts

Your bank accounts connect securely through Plaid to bring all your finances together in one place.

Set your goals

Tell us what matters most, like buying a home, saving for a wedding, or retiring earlier.

See your full financial picture

View what you own, what you owe, and where you stand today clearly in one app.

Get your plan

In minutes, receive a personalized AI plan that adjusts as life and markets change and gives you simple next steps.

Affordable for everyone

No high minimums. Low, transparent pricing so you can start with any amount and build at your pace.

a trip and still pay rent on time.

so you can do both without stress.

between fun and bills?

Ready to take control of your money?

Plan and invest all in one app that keeps up with your life.

Bonsai Smart Wealth Ltd ("Bonsai") is a financial technology platform providing educational content, portfolio tools, and AI-generated insights for informational purposes only. Bonsai is not registered as an investment adviser with the SEC or any state regulator and does not provide personalized investment advice or recommendations to buy, sell, or hold securities. All investing involves risk, including loss of principal. Past performance and backtested or hypothetical results are illustrative only and not guarantees of future returns. Bonsai's AI tools generate insights based on user inputs and historical data but are not personalized recommendations and may contain errors. Bonsai does not custody or control user assets; any investments are held with independent, third-party qualified custodians.

© 2025 Bonsai Smart Wealth Ltd. All rights reserved.